Download Guide: Designing Your Customer Experience

Iris Identity Protection API Suite

Power your own identity, credit, and cyber protection features directly within your digital product.

What the Iris Identity Protection API Suite Offers

The Iris Identity Protection API Suite and SDKs give you the flexibility of seamless integration into your existing digital properties, such as your software product, mobile app, online member portal, or other environment.

Compared to typical API integrations that can take 3+ months, a leading fintech client went live in under 1 month using Iris’ developer-first API and hands-on integration support – cutting implementation time by as much as 70%.

Working with Iris as a Platform API Partner

No one else is doing quite what we’re doing.

We bring the world of identity and cyber protection services right to your fingertips.

Build and Launch Quickly

Tailor to Your Business

Access Expert Guidance and Support

Outsource Sensitive Data Handling

Enjoy World-Class Security

Leave the Maintenance to Us

Solutions Available via Iris API Suite and SDKs

Identity Monitoring API

Available worldwide, Identity Monitoring securely monitors the dark and deep web for specific pieces of information provided by consenting customers – allowing you to provide proactive alerts when suspicious activity involving such data is detected.

Iris supports a wide range of monitorable data types and gives you flexibility in how you present the solution. You’ll also receive practical guidance to help you construct a secure, trustworthy experience that inspires confidence in your customers.

Credit Services API

Credit Services enables you to offer US customers credit alerts, credit scores, and full credit reports – key tools in staying ahead of identity fraud.

With Iris, integrating any or all of our available Credit Services components into your product is is fast and efficient – potentially saving you weeks or months. We give you clear blueprints to follow for key aspects like customer authentication, testing, and security. Credit Services is most commonly implemented via our Web SDK.

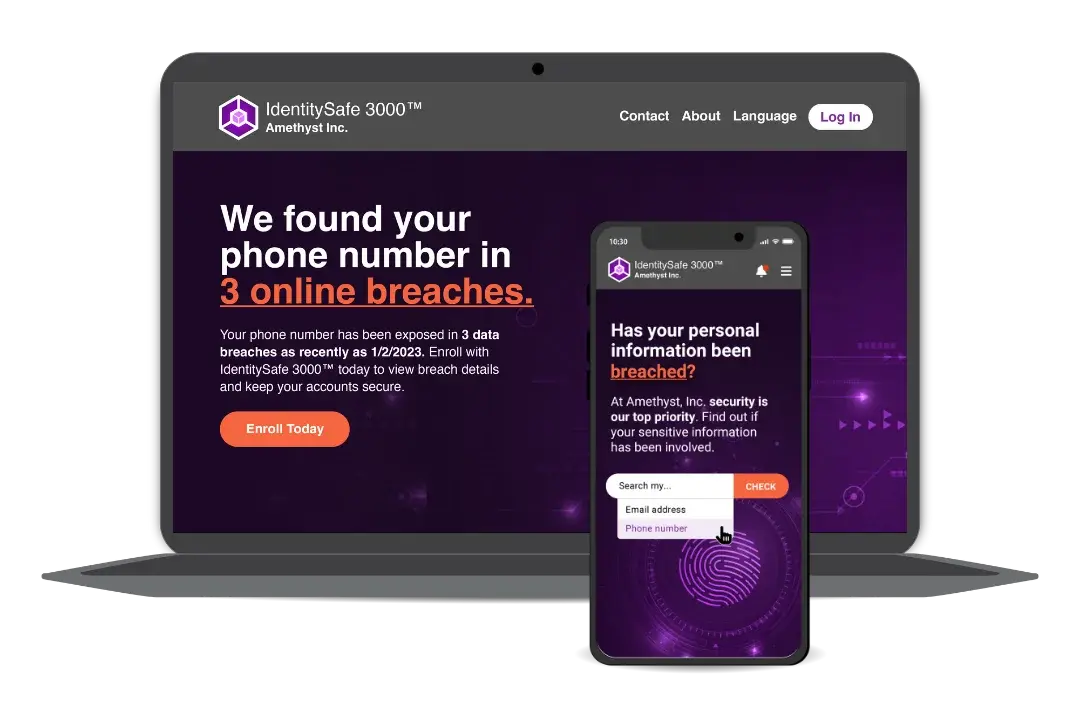

ID Health Check API

ID Health Check enables your customers to run on-demand searches of the dark web to see the latest exposures of their email address and/or phone number.

It’s a fast, high-impact way to drive customer engagement and generate demand for your larger offerings. By integrating ID Health Check into your customer journey via the Iris API Suite, you can quickly give customers a taste of the value that they will get with the rest of your program.

Even post-enrollment, it continues to provide immediate insights that complement your other forms of monitoring and protection.

High-Risk Transaction Monitoring API

High-Risk Transaction Monitoring enables you to provide near real-time alerts to US customers when their identity is being authenticated by a company or institution.

Typical scenarios include signing up for a new account, signing into an existing one, or contacting customer service. These alerts allow customers to quickly confirm legitimate activity (if they initiated it themselves) or take prompt action to contact the institution (if they did not initiate the transaction) – helping to reduce their risk of fraud.

The Iris platform makes it simple to enroll customers in this service and relay alerts when transactions are detected.

Caller ID Monitoring API

Caller ID Monitoring enables you to provide near real-time alerts to US customers when spoofing activity is detected on their monitored phone number – whether it’s an incoming call using a spoofed caller ID or an outgoing call made to impersonate them.

The Iris platform makes it simple to enroll customers in this service, update which phone number is monitored, and relay alerts when spoofing activity is detected.

Home Title Monitoring API

Home Title Monitoring enables you to provide alerts to US customers when we detect changes to public records involving their monitored real estate properties.

The benefit to you of using Iris as your provider for Home Title Monitoring is immense. Our data pipeline covers over 98% of US counties – we process complex, varied data from them so you don’t have to. We give you a ready-made API structure to enroll customers, receive and parse the latest changes in public records, and provide meaningful alerts. We make it easy for you to add Home Title Monitoring to your product, and then get on with the business you want to be in.

Social Media Monitoring API

Social Media Monitoring enables you to provide alerts to your customers when we detect suspicious activity involving their monitored social media accounts. Networks include Facebook, Instagram, Twitter/X, TikTok, LinkedIn, YouTube, and Snapchat.

The Iris platform makes it easy to manage key functions like linking and unlinking social media accounts for monitoring, reminding customers to renew expiring links, and relaying alerts – including pulling info to enrich them, such as displaying a sample of the suspicious content.

Personal Web Defense API

Personal Web Defense is a downloadable app for desktop, tablet, and mobile that provides robust digital security and privacy protections – including a VPN, antivirus, secure browsing and adblocker, and parental controls. And it works on Windows, Mac OS, Android and iOS.

The Iris API Suite makes it easy to distribute the Personal Web Defense app via your own product or digital environment – allowing your customers to activate and manage their Personal Web Defense user accounts, install the app, and extend protection to family members.

Designing Your Customer Experience

Want to see in more detail how you could use the Iris API Suite to offer identity monitoring and credit monitoring within your own product or environment? Download our free guide to learn more!

Assistance Services to Pair with Your Iris API/SDK Solutions

Resolution Services and Identity Fraud Insurance

Our award-winning 24/7/365 Resolution Services is a key advantage of working with Iris, and a critical component of your identity, credit, and cyber protection offerings. Resolution Services can be paired with any Iris API Suite solutions (and is always included with certain solutions, such as Credit Services). This provides your customers a professionally certified US-based team dedicated to identity theft, fraud, scam, and related issues – available anytime via phone and email.

Add Identity Fraud Insurance

As a supplement, your program can include an identity fraud insurance policy up to $3 million for eligible US customers. Available plans include up to $3 million in Identity Fraud Expense Reimbursement for covered expenses, Home Title Fraud, and Cyber Extortion, and up to $1M in Cash Recovery for unauthorized electronic fund transfers from Checking & Savings Accounts or Investment/Health Savings Accounts.*

*Identity Fraud - Expense Reimbursement, Cash Recovery Aggregate, and Investment & HSA Cash Recovery benefits are underwritten and administered by American Bankers Insurance Company of Florida, an Assurant® company, under group or blanket policies issued to Iris® Powered by Generali for the benefit of its Members. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits at https://www.irisidentityprotection.com/terms-conditions.

Personal Cyber Protection

Our cyber protection services are designed to help reduce the risk of cybercrime interrupting consumers’ lives by providing a suite of online data protection software along with the personal advice and technical assistance consumers want.

ScamAssist®

Scammers today use increasingly convincing tactics — making it hard for consumers to discern legitimate messages from deceptions. When your customer receives a message that they suspect is a scam, how can they tell if it’s safe to interact with it? ScamAssist is a distinctive scam analysis tool and 24/7 service that helps your customers avoid falling for scams of all kinds.

Beneficiary Companion

Identity theft after death is a widespread and unfortunate issue that many grieving loved ones must grapple with. This is why we created Beneficiary Companion – because we also know that it can be painful and difficult for beneficiaries to jump to the mountain of tasks required to help prevent it. With Iris, they can focus on healing, while we focus on keeping their loved one’s identity secure.

Interested in Learning More? Let's Connect!

According to our 2025 Identity & Cybersecurity Concerns Survey, 8 in 10 consumers say they would use identity protection features if they were integrated into a mobile app they already use.

The Iris API Suite and SDKs meet you where you are — whether you integrate with other tech all the time or are simply considering this option. Elevate your brand reputation and competitive strength by adding a secure identity protection feature to your product today.

.png?width=102&height=102&name=Iris-Generali-Logo-White%20(1).png)