Javelin Strategy & Research’s 2021 Child Identity Fraud study examines the behaviors, characteristics, and social media platforms that put children at the greatest risk of their identities being stolen. It also serves as a resource for parents, educators, and the general public to help identify, resolve, and prevent child ID theft and fraud.

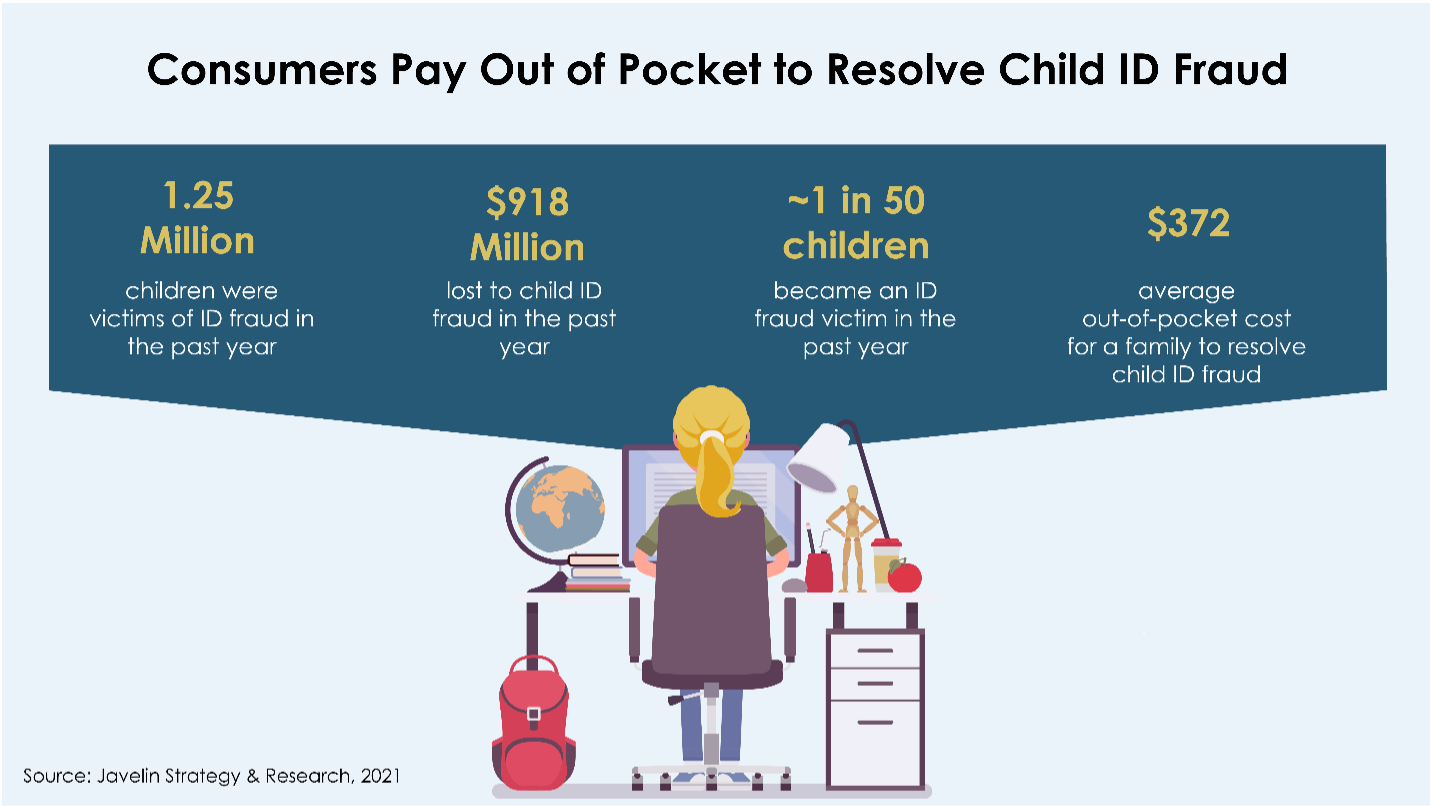

SAN FRANCISCO, November 2, 2021 – More than 1.25 million children in the United States fell victim to identity theft and fraud in the past year, costing the average affected family more than $1,100, according to the 2021 Child Identity Fraud Study, released today by Javelin Strategy & Research, part of the Escalent family. The topic has taken on new and concerning relevance amid the accelerating use of social media, remote learning, and digital purchasing. The report reveals that over 70% of child identity theft and fraud victims know their perpetrators, and over half of all cases involve children ages 9 and younger.

This complimentary report, sponsored by the AARP Fraud Watch Network, ID Watchdog from Equifax, and Iris Global Identity & Cyber Protection, powered by Generali, delves into child ID theft and fraud in the United States and showcases the behaviors and characteristics that put children at the greatest risk. The report also equips consumers with resources and advice to help identify child ID fraud, resolve it, and prevent it from happening in the future.

“Javelin has been analyzing identity theft and fraud trends for nearly two decades, making us uniquely qualified to shed light on its growing impact on children,” said Jacob Jegher, President of Javelin Strategy & Research. “We are therefore providing a complimentary resource of insights and guidance to families as they navigate the perils of social media and the digital world.”

Social Media and Messaging Apps Pose Hefty Risks

“One of the most eye-opening findings from our research was just how much risk children are exposed to when they are not supervised online. Add to that nearly 90% of the households with internet access say they have children on social media, and the picture our findings paint quickly becomes dark, grim, and scary,” said Tracy Kitten, Director of Fraud & Security at Javelin Strategy & Research. “Predators and cybercriminals lurk in the wings of all social media platforms, waiting for the moment to prey on overly trusting minors who may not fully understand safe online behavior.”

Children who use Twitch (31%), Twitter (30%), and Facebook (25%) were most likely to experience the exposure of their personal information in a breach. Javelin also notes that unknown risks exist on relatively new platforms, such as TikTok, requiring parents and guardians to keep up with these rapidly evolving spaces.

Recommendations for families to help reduce the risks of child identity fraud:

- Keep personal information private, online, and on paper.

- Don’t share your childrens’ information on social media.

- Set positive online examples for your children by practicing safe online behaviors yourself.

- Limit and monitor the use of social media and messaging platforms.

- Monitor your child’s online activity, particularly as it relates to potential cyberbullying.

- Platforms that allow users to direct/private message (DM), friend, or follow other users via public search pose the greatest concern.

- Keep a watchful eye on your child’s credit and consider freezing it.

- Enroll in an identity protection service.

Click here to download a complimentary copy of Child Identity Fraud: A Web of Deception and Loss

About Javelin Strategy & Research

Javelin Strategy & Research, part of the Escalent family, helps its clients make informed decisions in a digital financial world. It provides strategic insights to financial institutions, including banks, credit unions, brokerages, and insurers, as well as payments companies, technology providers, fintechs, and government agencies. Javelin’s independent insights result from a rigorous research process that assesses consumers, businesses, providers, and the transactions ecosystem. It conducts in-depth primary research studies to pinpoint dynamic risks and opportunities in digital banking, payments, fraud & security, lending, and wealth management. For more information, visit javelinstrategy.com. Follow us on Twitter and LinkedIn.

###

Media Contact

Tejas Puranik

Marketing Manager

tejas.puranik@javelinstrategy.com

.png?width=102&height=102&name=Iris-Generali-Logo-White%20(1).png)