Class Action Settlement Administration

Identity & Medical Information Monitoring

from Iris® Powered by Generali

From monitoring to resolution, we've got you covered

Comprehensive Solutions

for Class Action Litigation

With over 20 years of experience in the identity & cyber protection space, Iris Powered by Generali supports leading organizations including Mastercard, GEICO, Legal Resources, and Nationwide.

Iris provides comprehensive identity and medical monitoring solutions for class action settlement administrators, including:

| Medical information monitoring. Our industry-leading medical monitoring scans the dark web for sensitive medical information, including MRN, MBI, HSA/FSA, and NHS information, alerting individuals and providers when this data is detected. | |

| Efficient, flexible delivery. From eligibility codes to SSO, Iris provides multiple delivery and member enrollment options. | |

| Multinational capabilities. With solutions in 120+ countries, multilingual support, and regionally relevant protection features, Iris is equipped to provide global support. | |

| People-first resolution support. Our 24/7/365 U.S.-based resolution experts deliver compassionate, live support, with a 96% customer satisfaction rating. |

Industry-leading solutions for class action settlement

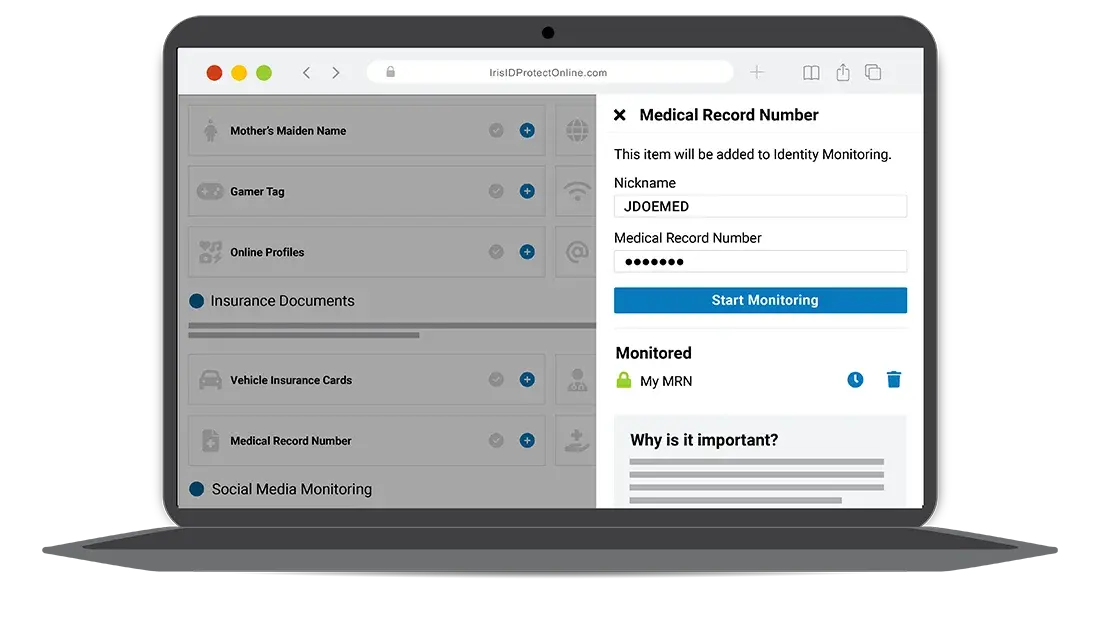

Medical Identity Monitoring

We monitor the dark web for sensitive medical information, alerting individuals and providers if the following data is found:

| Healthcare Insurance ID Scans the dark web for compromised medical, dental, vision, and prescription plan identifiers – alerting individuals if their health plan details are found in places they shouldn't be. |

|

| Medical Record Number (MRN) Detects exposure of MRNs, which can unlock access to full medical histories, diagnoses, treatments, and personal health data – posing serious risks of fraud or misuse. |

|

| Medicare Beneficiary Identifier (MBI) Monitors for signs of Medicare ID theft that could lead to false claims, billing fraud, or illegal access to healthcare services. |

|

| National Health Service (NHS) Number Identifies UK-specific NHS number exposures on the dark web, alerting individuals if their unique medical ID is at risk of abuse. |

Provide Class Members Comprehensive Identity Protection

Let Iris help you deliver the identity monitoring and protection services required by your data breach settlement agreements. We have the specialized services and technology to meet the unique needs of breach-affected class members.

Partner with Iris to provide real protection, real monitoring, and real peace of mind

for individuals whose personal information may have been compromised.

Medical Identity Monitoring

We monitor for exposure of sensitive medical credentials across the dark web and criminal marketplaces, alerting individuals when data tied to insurance, treatment, or prescriptions is at risk. This includes Healthcare Insurance IDs, MRNs, MBIs, and NHS Numbers – key elements in medical identity theft and fraud.

Health Savings Account (HSA) and Flexible Savings Account (FSA) Monitoring

High Risk Transactions Monitoring

Provides alerts when attempts are made to access sensitive online accounts, such as healthcare portals or banking accounts, where multi-factor or identity authentication checks are involved.

Dark Web Monitoring

Single- or Tri-Bureau Credit Monitoring

24/7/365 Fraud Resolution

Identity Theft Protection Toolkit

Online Fraud Protection Center

Monthly Risk Alerts

Up to $1 Million Medical Identity Theft Insurance

Reimbursement for covered expenses related to the identity recovery process.*

Up to $1 Million Unauthorized Electronic Fund Transfer Reimbursement

Cash Recovery for unauthorized electronic fund transfers from Checking & Savings Accounts or Investment/Health Savings Accounts.*

Why Choose Iris

Iris® Powered by Generali is a B2B2C global identity and cyber protection company owned by the 190-year-old multinational insurance company, Generali, that feels passionately about not just developing effective identity protection solutions but also integrating them into people’s lives in a meaningful and impactful way. We first opened our doors with a simple mission, to bring customers from distress to relief – anytime, anywhere– and went on to become one of the very first identity theft resolution providers in the U.S. in 2004. Today, we partner with some of the world’s most well-known brands, protecting their people how they want to be protected, no matter where they are.

*The Identity Fraud Expense Reimbursement benefit is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company, under group or blanket policies issued to Policyholder or its respective affiliates for the benefit of its Members. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits..

.png?width=102&height=102&name=Iris-Generali-Logo-White%20(1).png)