.webp?width=621&height=414&name=ezgif.com-png-to-webp-converted%20(1).webp)

Estimated Reading Time: 6 Minutes

Consumers have much to worry about this holiday season – from global conflict to inflation and the ever-present threat of becoming a victim of scams and identity theft.

While some consumer concerns are out of a company’s control, there is a solution to help empower your customers and give them the peace of mind they deserve: an identity protection service. Identity protection services play a crucial role in reinforcing customer loyalty and trust in your brand, helping position you as more than just a business but as a trusted and caring entity.

Consumers are turning to the brands they trust – like yours – to help keep their data and identity safe. It’s up to you to reinforce that trust by offering them identity and cyber protection services.

But first, what is brand trust?

What is Brand (aka Consumer) Trust?

As defined by Qualtrics, brand trust (also known as consumer trust) is the confidence customers have in a brand's ability to fulfill its commitments. As a brand consistently meets or surpasses the expectations it has established in customers' minds, trust will continue to grow.

Various factors, such as the quality of products and services provided, cost-quality ratio, standard of customer service, security measures for customer data, a consistent customer experience, etc., influence consumers' trust in a company. Essentially, brand trust is shaped by how well a brand aligns with its proclaimed values and delivers on its commitments.

Scams, Identity Theft, and the Impact on Brand Trust

Every year, millions of consumers fall victim to scams and identity theft, often leading to financial loss, emotional damage, and more. When a consumer is targeted by identity theft/fraud or a scam – whether it’s through a phishing attack, data breach, or some other cybercrime – the aftermath often leaves consumers feeling some level of distrust toward a brand, particularly if the brand’s image or likeness was used in a phishing attack or experienced a data compromise.

Download the Iris Holiday Shopping Identity Theft ebook for more insights.

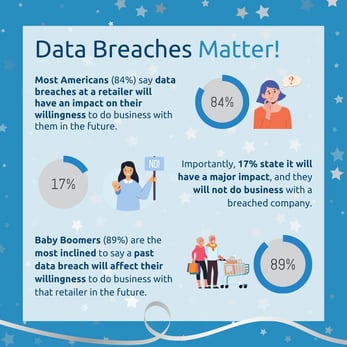

According to Iris Powered by Generali’s 7th Annual Holiday Shopping Identity Theft survey, nearly 73% of Americans expressed concern about their financial or personal information being compromised due to a data breach while shopping this holiday season. In fact, 17% of survey respondents said they would avoid doing business with a company that has experienced a breach.

As growing concerns surrounding scams and identity theft continue to rise, it’s up to companies to provide the necessary services and tools to help keep their customers safe.

Consumers Say They Trust These Entities with Their Personal Data…

Survey respondents reported that credit card providers, e-retailers, and big box stores are the top three entities they trust the most to securely handle their personal data this holiday shopping season.

Download the Iris Holiday Shopping Identity Theft ebook for more insights.

Whether or not your company falls into one of these categories, you can still offer more value and protection resources to help strengthen brand trust.

Let’s look at an example using credit card companies. Historically, financial institutions have been among the most trusted entities for handling sensitive information, thanks to robust security measures and regulatory compliance. Iris’ Holiday Shopping Identity Theft survey further proves this sentiment. When respondents were asked who they felt they could trust to handle their personal information, 36% said they trusted their credit card provider the most.

However, another study found that one-third of cybercrime victims expressed frustration and dissatisfaction with their financial institutions’ efforts to resolve their fraud issues. This frustration ultimately led to 38% of these victims closing their accounts at the financial institution where the fraud occurred.

No business wants to lose customers, and an identity protection plan for your end-users helps fortify trust and keep your customers satisfied and loyal.

Strengthening Trust: Tips for Businesses

So, what can businesses do to build brand trust?

- Proactive Education: Empower your customers to fight back against fraud and scams with educational tools and resources. Iris’ Fraud Protection Center (available through our OnWatch® Portal experience) gives end-consumers access to educational resources, such as articles explaining fraud alerts, credit freezes, tips to recognize and avoid fraud, and more.

- Inform Customers About Their Risks: Scammers often imitate well-known brands to trick consumers into giving away their money and personal information. As a company, it’s up to you to inform your customers about the signs of an impersonation scam. If you need assistance creating educational campaigns for your customers, Iris’ partner marketing support can help. Our team can help you get started by assisting you with designing compelling campaigns, developing personalized collateral, and so much more.

- Partner with Iris: Over 3 in 4 Americans would feel more secure if a retailer or other consumer brand offered services to help reduce their risk of falling victim to fraud and scams. Businesses can leverage a partnership with Iris to provide the tools and services necessary to help keep their customers safe, such as ID Monitoring & Alerts via API, ScamAssist, and more. Keep reading to find out which solution(s) might be right for your business.

How Can Iris® Help?

Every Iris solution is designed to educate your customers about the risks of scams and identity theft/fraud and help protect them from cybercriminals – strengthening your company’s trustworthiness. Our most popular services include:

-

Identity Monitoring & Alerts – With Identity Monitoring & Alerts, your customers are notified if their information is found on the dark web so they can take action to secure their data. Your customers’ personal information – including their name, phone number, email address, and more – will be monitored on the dark web, 24/7, 365 days a year. Plus, you can choose between two different delivery models, depending on your business needs: either via our API, which can be seamlessly integrated into your existing digital product, or through our flagship OnWatch® Portal, which Iris builds for you in the branding of your choice.

- Credit Monitoring & Alerts – Credit Monitoring & Alerts offers your customers peace of mind by sending them a notification whenever suspicious activity is detected on their credit file. This service, which can be accessed via the OnWatch® Portal, can also help your customers spot any errors or unauthorized changes on their credit report that they might have missed. Plus, it pairs together perfectly with our Identity Monitoring & Alerts service!

- ScamAssist – ScamAssist is a distinctive scam analysis tool that combines proprietary scam evaluation technology and human review to help customers avoid scams. ScamAssist is easy to use and can be added to your OnWatch® Portal that Iris builds for you or offered as an individual micro-experience. Your customers can use ScamAssist to submit suspicious communications online or contact our Resolution Specialists to review other types of messages, including email, phone, text messages, and direct mail.

Click here for a full list of Iris’ solutions.

Adding identity protection services to your company’s product portfolio or existing digital experience can help rebuild and strengthen brand trust while also helping to protect your customers from cybercriminals this holiday season and beyond.

Contact our team to learn how you can get started!

.png?width=102&height=102&name=Iris-Generali-Logo-White%20(1).png)