Profits may be booming for many insurers, but that doesn’t mean the industry isn’t without its challenges. Fast-evolving technology and companies from other sectors looking to get their share of insurance profits are causing major disruptions that threaten the continued growth of many current market leaders.

As many insurance companies already know, it costs five times as much to attract a new customer than to retain one. For this reason, many insurers have smartly chosen to put equal, if not more, focus on retaining existing customers rather than attracting new ones. However, with market disruptors such as InsureTech and auto manufacturers offering new products and services in increasingly innovative ways, smart insurers are looking for ways to add value to their customer relationship in order to deter them from switching providers.

Growing Customer Loyalty with an Expanded Product Ecosystem

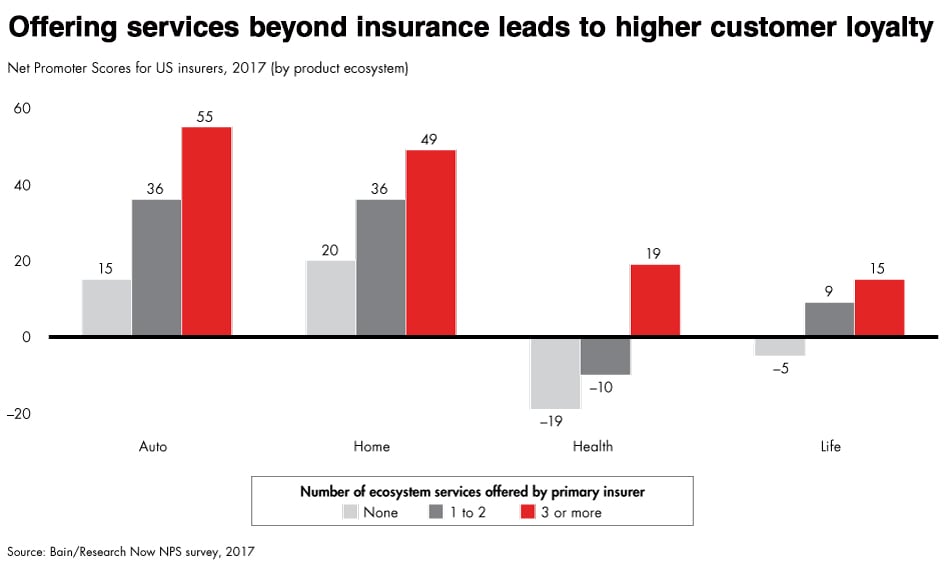

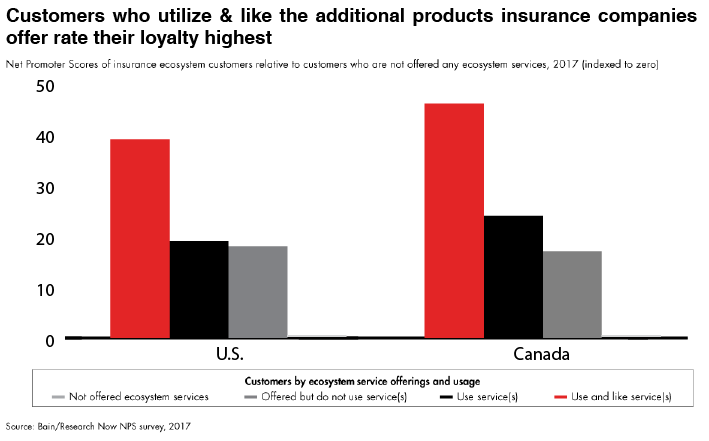

One popular way companies are doing this is by adding new products and services to their more traditional offerings, in an effort to build out their product ecosystem. A recent study by Bain confirms this can be an effective approach, revealing that across all insurance company types, offering more services leads to higher customer loyalty – regardless of whether the customers actually use them or not.

However, customers who do actually utilize the additional products insurance companies offer rate their loyalty even higher, and those that both use and like those services rate their loyalty the highest. This means that insurance companies looking to make themselves as competitive as possible should be selective about which products they add to their selection set and the companies they partner with to offer them. Doing so can have a significant impact on reducing customer churn, as 45% of consumers shared they would switch insurance providers to one that offers all the services they are looking for.

The Importance of Selecting the Right Products & Services

Customers reward the most loyalty to companies who offer them services that best meet their needs. The same, aforementioned Bain study revealed that the largest and fastest-growing group of insurance customers prefer to have the option to interact with their service providers via multiple channels including online and over the phone. In addition, those companies that had multi-channel interactions with their customers had higher net promoter scores (NPS) than their counterparts who preferred only online or offline interactions.

The frequency and quality of those interactions also had an impact on customer loyalty. Customers who had more frequent interactions with their insurance carriers had a huge positive difference in NPS those who did not. While communication frequency has traditionally been a challenge in the insurance industry, which by its nature is low-touch, adding the right products and services into their ecosystem can offer the opportunity to engage with their customers in more positive ways.

And, the positivity of an interaction is also critical. There is a huge disparity in average NPS across customers who were delighted by their interactions versus annoyed by them. Not all engagements are created equal. Customers don’t want to receive repeated, multi-channel reminders to renew their policies; however, they do want to receive communications that provide value to their lives.

So what services can insurance companies add into their ecosystem that actually check the boxes of (1) being likely for consumers to utilize, (2) provide multi-channel engagements, (3) provide those engagements frequently, and (4) are actually perceived as value-added by customers? An increasingly popular one is identity protection. With over 50% of consumers reporting they plan to purchase identity protection in the next two years, and more than half of them looking to their trusted insurance institutions to buy it, you can rest assured that identity protection is a service many of your customers are not only looking to purchase but will look to your company to buy it from. Quality identity protection will provide your customers with the other three items you are looking to check the boxes for as well, in addition to providing your company with customers’ resulting loyalty and increased retention.

Selecting the Right Identity Protection Partner

When it comes to expanding ecosystems to those outside their traditional offerings, many insurance companies are offering products under their brand or a co-brand through a strategic partner rather than developing them in-house. One example of such a partnership is Desjardins which is offering Ajusto, an app that tracks driving behavior and calculates discounts based on how safely motorists operate their vehicles, or USI Insurance Services which is offering Generali Global Assistance (GGA) identity protection under a co-brand.

Partnering with an established provider of such products and services can not only be a cost-efficient way to provide best-in-class offerings to your customers, but can also be an effective way to cut back on administration and marketing efforts. The right identity protection partner will frequently engage with your customers across multiple channels to offer them value-added content and support, such as our monthly risk alert emails that include educational content developed by our award-winning marketing team and phone support available 24/7/365 with our certified, award-winning resolution team. Additionally, while many companies that offer program administration and marketing support offer it with the stipulation of having limited branding or features flexibility and/or charging high minimum sales, we pride ourselves on offering personalized, white-glove administration support to all our partners. We offer a variety of product bundles so you can offer the right selection of features and services for your customers’ needs and make it easy to help partners launch, market, and continue to grow their programs by offering tailored account management, business development, and marketing support.

To learn more about differentiating your insurance company from the competition and growing your retention with GGA identity protection services, request a demo today.

.png?width=102&height=102&name=Iris-Generali-Logo-White%20(1).png)